Estate Planning

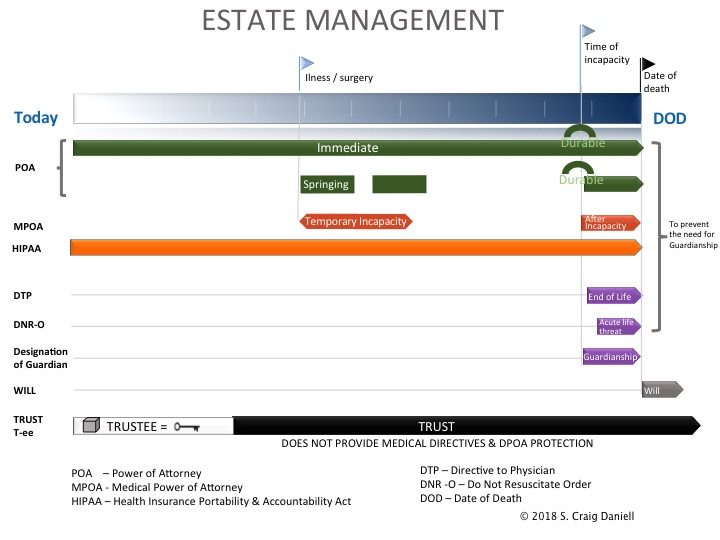

Estate planning is more than just a Will and disposition of your assets. Planning for the time from today until your death is quite possibly the most important consideration for you and your family.

That is why our “estate planning package” includes all of the documents that you and your loved ones need to manage your affairs under the changing circumstances we all face as we age; from young adults who have recently attained their majority to busy people who travel for business or pleasure, and those who become physically or mentally infirm.

Click the  's to see more information.

's to see more information.

Preventing the Need for Guardianships

Your medical directives (Medical Power of Attorney, Directive to Physicians with your HIPAA release) and a Durable Power of Attorney make up your “estate planning package”. All of these important documents are integral to preventing the need for obtaining a Guardianship for you or your family members as they age. A guardianship is always expensive, cumbersome (Annual Accountings and reports) and intrusive (requiring Court permission for even minor expenditures and other actions). There are almost no situations that do not become more challenging when Guardianships are involved.

The Protection of a Will

Of course, a Will is important for planning for our families after our death. A Will should name the person(s) to whom we want our assets distributed, the person who we want to administer our affairs and provide for the Guardianship and financial protection of minor children.

Avoiding Probate

There are other planning tools we have today that can prevent the necessity of “going through probate”, like the “Transfer on Death Deed” that eliminates the most common need to probate an estate, the transfer of title to real property.

Your Family without a Will

Without a Will, the laws of the State of Texas will determine your heirs and the person or persons who will administer your estate. This is almost always more expensive and seldom provides the protection that you want and need.

Estate Taxes

Of course, if you have substantial assets that exceed the Federal Estate (death) Tax threshold, you will need our help in avoiding those taxes. The current rate is 40% for all assets that exceed $5.45 million for an individual. For married couples, portability can protect up to double that amount. For more information concerning estate taxes, consult the following link https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax