- Serving The Woodlands, TX

- 281-825-8674

- Law2@daniell-law.net

What Can Happen When I Forget My Non-Probatable Assets? Catastrophe!

Those We Leave Behind

2018-10-24

Transfer on Death Deed – An Easy Way to Avoid Probate

2019-10-16Not long ago, Mrs. Sutherland came to my office. She was married to Mr. Sutherland before he died unexpectedly. They had two small children together. It was the second marriage for both of them. They had made new Wills with us after their marriage and his Will leaves everything to Mrs. S., but he forgot to change the beneficiary on his life insurance policy with his employer, and who is the Beneficiary ????, Mr. Sutherland’s first wife!!!

Result– Mrs. S number two (2). is now left with two small children, a house and a mortgage, two cars with payments and insurance, no income from Mr. X; and,

Mrs. S #1 got a half million dollars $500,000.00 cash to add to her retirement fund or take an extended vacation with her new lover.

You must, know the impact of designating the beneficiaries for your non- probate assets.

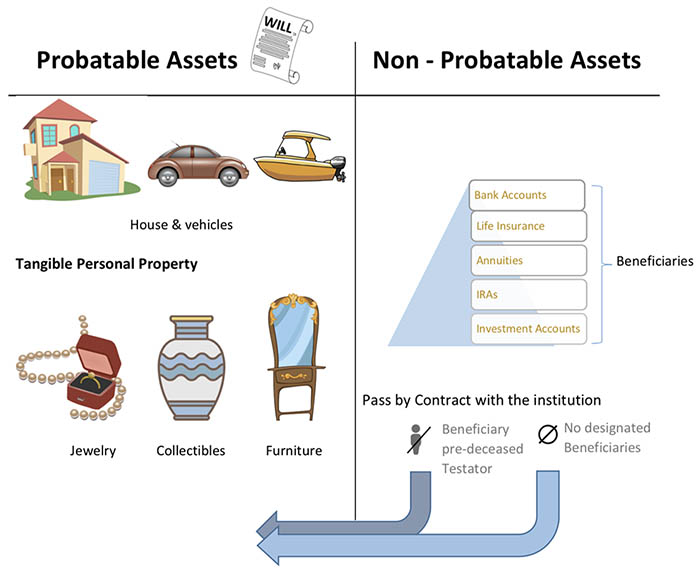

“Your Probatable and Non-Probatable Assets” Chart – © 2018 S. Craig Daniell

So whenever you have a change in life circumstance, (marriage, divorce, children, grandchildren, new employment, change of residence) you need to check the beneficiary designations for all of your non-probatable assets: bank accounts, IRAs, retirement accounts (social security, company retirement, military retirement) so that your estate plan with you probatable assets is directed toward the same distribution goal as your probatable estate.

Give us a call so we can review your total plan to insure it provides the protection for your family that you want.

Craig Daniell – 281-825-8674